Part II: Two Lemonade Stands, 10,000 Runners: The Unique Opportunity in Indian Banking

PART II: Deposits, Discipline, and Dominance

Before we proceed, it would be prudent to clarify what part of the nation’s vast banking sector we are looking at (and why). Firstly, we are focusing on domestic as opposed to foreign banks in India, given the even higher barrier to entry in the market which effectively excludes them from participating meaningfully in the retail banking sector. As a result, any foreign institutions are largely confined to investment banking and capital markets, leaving the domestic players to dominate lending, branch expansion, and retail deposits.

This then begs the question - what is a deposit-taking bank, and why are we interested in them specifically? Deposit-taking banks (spanning Public Sector Banks, Private Sector Banks, Regional Rural Banks and Small Finance Banks, excluding Non-Banking Financial Companies) accept deposits from the public (individuals, businesses, and governments) and use those deposits to provide loans and other financial services. They can therefore be regarded as both the mirrors and primary drivers of a country’s economic growth, unlike the foreign or investment banks that operate in advisory or capital markets activities as just mentioned. Their fundamental role in a domestic financial ecosystem is also why deposit balances and credit growth are historically strongly correlated to nominal GDP growth - rendering it a powerful proxy for the broader health of the economy.

Now that we’ve sped through some theory, here’s the exciting part: not only is India’s banking asset base growing – it’s actually outpacing GDP. Indian deposit-taking banks are expanding their balance sheets at double-digit growth rates (CAGR of ~10-12%+; +11% YoY in FY20251), while nominal GDP growth has been lower (in the ~8-10% range). What is more – this delta is being actively encouraged by the government to widen as part of its national vision to transform the country by 2047 (an initiative known as ‘Viksit Bharat’). To achieve its goals, the banking sector is required to continue outpacing nominal GDP by at least 3-3.5 percentage points2. A key governmental program also meaningfully contributing to India’s deposit base growth by expanding access to formal banking is ‘Pradhan Mantri Jan Dhan Yojana’ (PMJDY) – a financial inclusion scheme launched in 2014 – which has led to the creation of over 450 million bank accounts and has mobilised substantial deposits among previously unbanked households (from $1.8 billion in 2015 to over $30 billion worth in 2025)3.

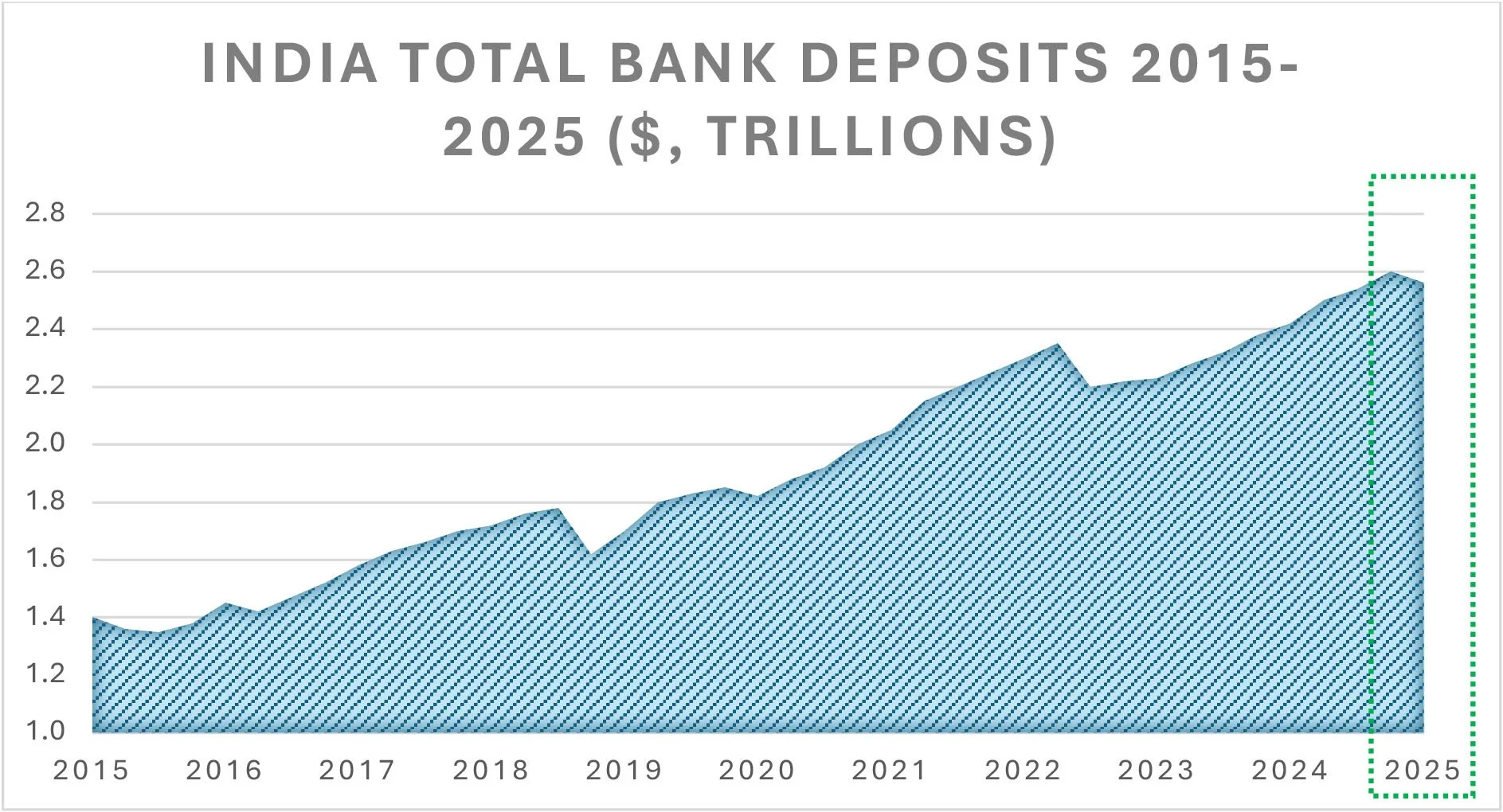

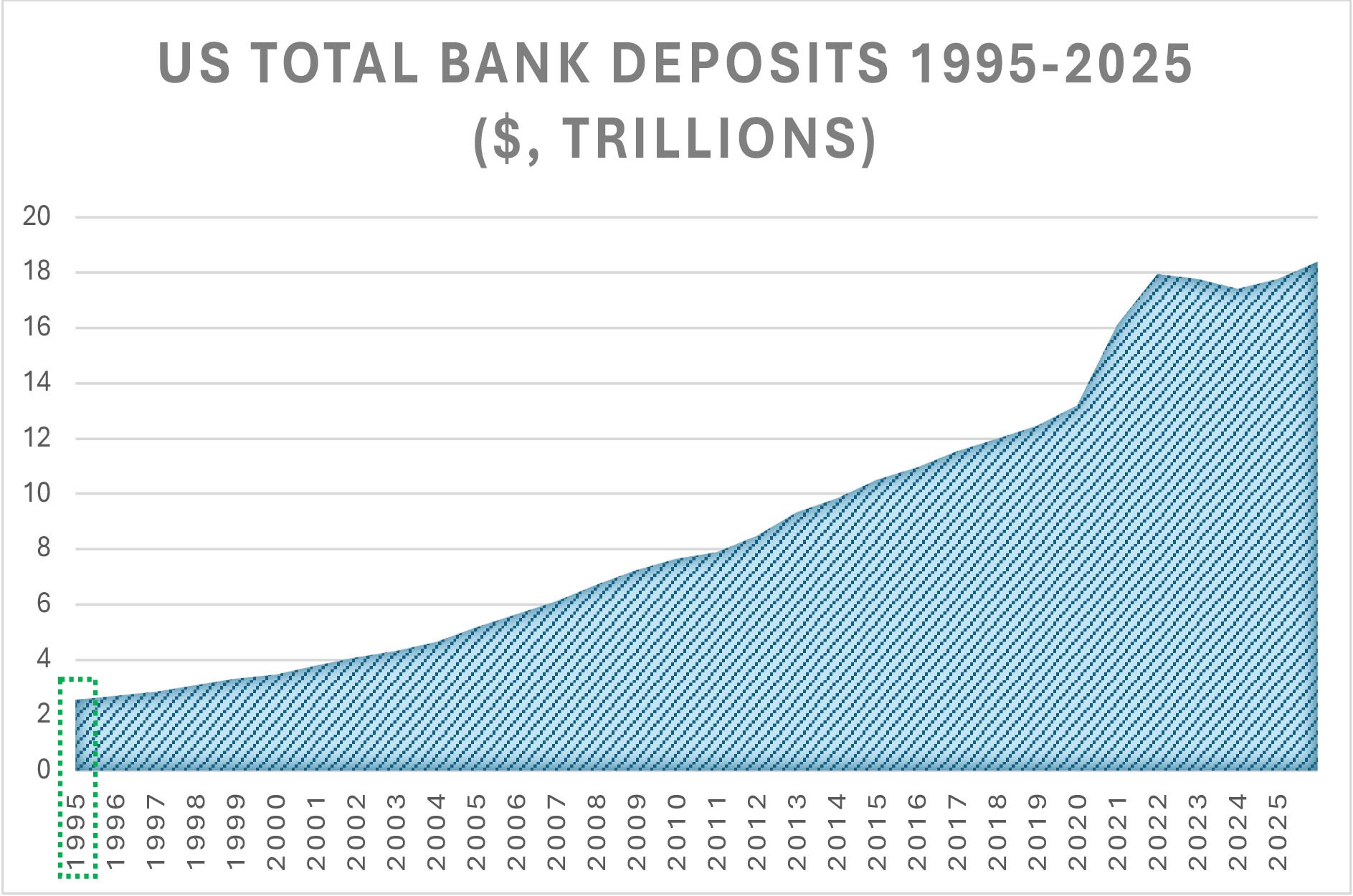

The divergence between Indian and US growth numbers reflects India’s position in a much earlier stage of financial deepening, where rapid balance-sheet expansion is both a driver and a symptom of broader economic growth, vs the matured US banking system. In the 15 years leading up to COVID-19, India maintained an average real GDP growth rate of around 8%, compared with under 2% in the US4, and in the space of 10 years (2015-2025), India’s GDP increased by nearly 200% compared with a 65% increase in the US. We use the US as our reference point because India is tracing a similar trajectory to the one experienced by the financial giant during its early growth phase decades ago, with accelerated expansion, rising deposits, increasing profitability, and broader retail engagement. Whilst China is also a major player in global finance, its drastically different regulatory environment and market structure means the economy offers limited insight as a comparable case study.

India’s total banking deposits stand at $2.6 trillion today5. In comparison, the total US banking deposits hit $2.6 trillion exactly 30 years ago in 19956, meaning it’s grown 7-fold in the last 30 years, or has effectively doubled every 10 years. For those of us that can appreciate an interesting coincidence – US banking deposits today are at $18 trillion, making the nation’s deposits to GDP ($28 trillion) ratio 64%. You’ve probably guessed the rest, but yes – India’s deposits ($2.6 trillion) to GDP ($4 trillion) ratio is also at 64%.

Whilst acknowledging the impressive pace of US growth, we still expect Indian banking deposits to grow at a faster rate because of the underlying growth factors explained earlier.

With economic expansion set to accelerate deposit accumulation, and with little change expected in the population of deposit-taking banks, those in position stand to benefit disproportionately. This convergence of rising demand and limited supply capacity forms a structural tailwind that reshapes the competitive landscape in favour of established players. Queue our lemonade stand and the onslaught of dehydrated runners.

Disclaimer

The analysis and opinions expressed in this article are intended solely for informational purposes and do not constitute investment, financial, legal, or other professional advice. They are not intended to recommend or solicit the purchase or sale of any financial products, securities, or services. The content is based on publicly available information believed to be reliable; however, no warranty is provided as to its accuracy, completeness, or timeliness. Forward-looking statements, projections, and analogies are inherently uncertain and are provided only to illustrate potential industry dynamics. Actual outcomes may differ materially. Neither the authors nor the publishing entity accepts any liability for decisions made or actions taken based on this article.

[1] BCG ‘Banking Sector Roundup – FY25’, May 2025 PowerPoint Presentation

[2] 'Banking sector must grow 3-3.5 percentage points faster than nominal GDP to achieve Viksit Bharat'

[3] Press Information Bureau - Government of India, June 2025 doc2025616570701.pdf

[6] Deposits, All Commercial Banks (DPSACBW027SBOG) | FRED | St. Louis Fed